If you’ve been waiting for the tax table updates from Sage for your Sage 100 ERP (formerly MAS 90 or MAS 200) be advised you can now download these from the Sage portal (in keeping with prior years there are NO disks sent by mail).

IRD (Interim Release Download): Interim Release Download contains the Year End program changes for Payroll, Accounts Payable and Electronic Reporting modules. It also contains necessary program changes for eFiling and Reporting.

TTU (Tax Table Update): Tax Table Update contains changes to applicable Federal and State withholding tax tables and wage limits, State Disability percentages and/or limits and State unemployment limits.

2013 IRD – Supported Versions:

- 4.40.0.1 – 4.40.0.10

- 4.50.0.0 – 4.50.0.7

- 2013 PU 3 – 4

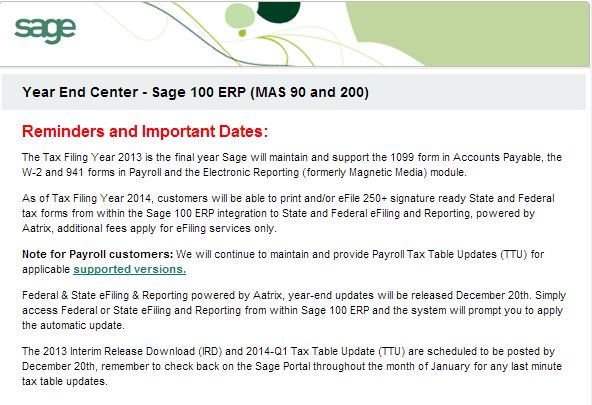

IMPORTANT: This is the last year that Sage will issue an IRD or W2 form changes. Next year in December 2014 you will use the Sage Aatrix for both form printing (1099 and W2) as well as electronic filing (The electronic filing module is replaced by Sage Aatrix).

Resources:

List of changes represented in the IRD for 2013 (pdf)

Frequently Asked Questions about FYE 2013 Filing

List of changes represented in the tax table update for 2013 (pdf)

Sage 100 ERP 2013 Year End Resource Page (Login to Sage Required – Partners or Customers)

You must be logged in to post a comment.