You have questions about closing the year for payroll and 1099 processing. Sage has answers. And those answers have been compiled into a great frequently asked questions knowledgebase article covering year-end 2021 closing.

If you’ve ever asked yourself any of these questions – then read the answers in the Sage KB 114052 which was just issued on 1/7/2022.

In order to process year-end, you should be on Sage 100 version 2019.5 or higher with the latest product update. Payroll users should be on payroll 2.22.x.

The article does address the question of whether you can run year-end from an unsupported version of Sage 100. The answer is that while year-end may appear to run properly you cannot be guaranteed of compatibility with the latest eFiling unless you are on a currently supported Sage 100 version.

- What updates do I need for payroll year-end? ( and do I need to update to Payroll 2.22.x ? )

- What updates are needed for AP year-end / 1099 forms?

- Can I run W2 forms from an unsupported Sage version ( Spoiler: Maybe but no promises )

- Can I run payroll for January 2022 before running period-end processing for payroll year 2021 in new sage 100 Payroll 2.0?

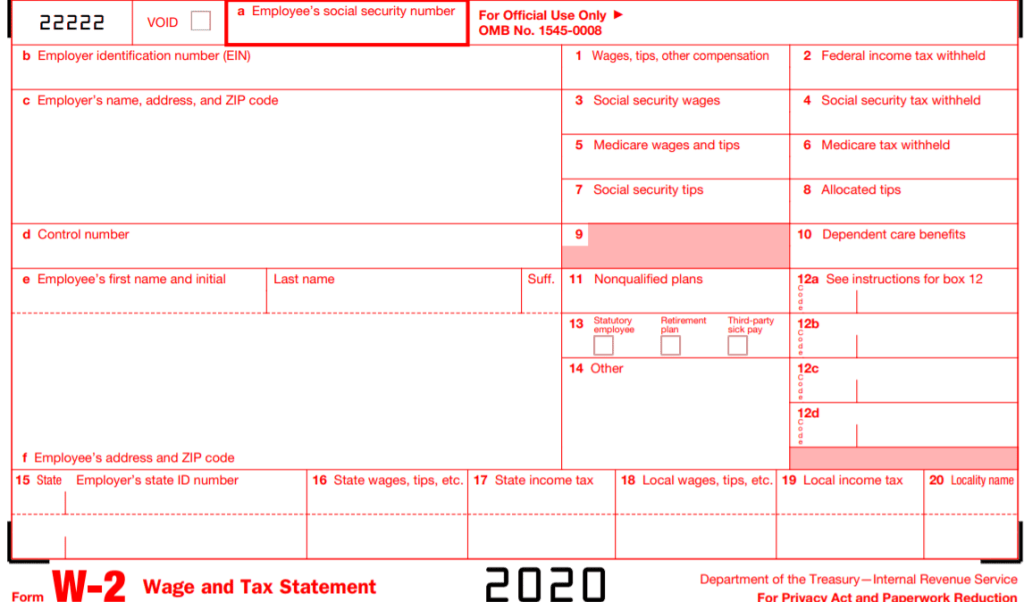

- Do I need to run my W2 forms before I run period-end processing?

- Do I need to create a year-end copy company ?

- In the past I’ve been instructed to run W2s from a year-end copy company, is this still accurate?

- What is the new 2020 W4 form for?

- Can I reopen a closed payroll quarter/year?

- Do I need to be active on a payroll support plan to run W2s and other year-end forms?

- Should the 2.22.0 payroll update be installed before or after closing 2021 and running W2s?

- How do I run NEC 1099 forms and what is required?

- How do I correct tax amounts on prior payroll checks during the year?

- Year-end processing appears to be hanging or running very slowly

- Getting error “Payroll expiration date is invalid” or user is locked out of payroll module

- Do I need to purchase forms when printing W2s and 1099s from Sage Federal and State Tax Reporting?

This is some of the most timely information you can find about closing the year and printing W2s and 1099s from within Sage 100.

In almost all cases you should be on the most currently supported version of Sage 100 along with the latest product updates to ensure maximum compatibility.

Some of the functionality from older unsupported versions of Sage may appear to work until you go to print forms or interface with electronic filing.

To stay updated with the latest Sage 100 news please join our weekly email newsletter – Schulz Says.

You must be logged in to post a comment.