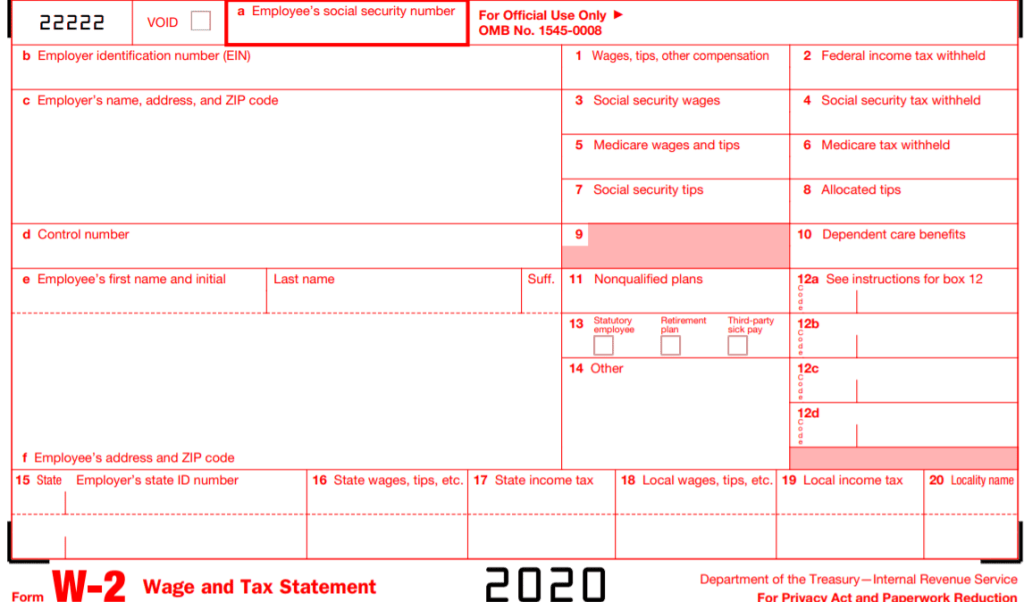

If you need to reprint an employee’s W-2 form from a prior year you’ll be happy to know that this is easily accomplished in Sage 100 payroll.

Unlike in legacy versions of payroll, Sage 100 payroll now retains historical information which enabled the re-printing of W-2 tax forms from prior years without needing to switch Sage 100 company codes.

From the Sage KB here are the steps:

Start by switching to Sage 100 Payroll

- Select Payroll, Period End

- Select Federal and State Tax Reporting

- Select Existing Report

- Select the W2 form, Edit, Reprint completed W-2s

- Print either: (a) All, (b) Selected or (c) Locally sorted copies

- Next – Reprint Employee options ( A) All, (B) Select or (C) Instructions Only

If you find yourself frequently reprinting W2 forms you might want to select one of the Aatrix options where Aatrix prints, mails and allows employees to access their W2 forms online. This might relieve your accounting department of the need to reprint and research prior year W2 forms for employees.

You must be logged in to post a comment.