I think in the coming years we will see significant compliance audits by the Government (State and Federal) looking to recover every bit of tax money they can.

Update: Read this WSJ article 6 States Hitting Residents With Big Tax Hikes

If your company is collecting sales tax for multiple states or if your monthly sales tax liability is significant – and you’re not already using a service to help prepare your sale tax returns and calculate the proper tax on every transaction – why?

One common mis-conception about sales tax is that if a company is audited for sales tax they will just re-bill their customer for any tax mistakes.

Wrong

Hardly every happens.

And if it does (provided tax law allows for re-billing the tax) – good luck collecting from your good customers.

Even better luck collecting from the deadbeats…

The only way I’ve seen clients “beat” the Government out of a sales tax audit is to have books and records that are in tip top shape.

If you’re collecting sales tax for several states it’s virtually impossible to keep up-to-date on sales tax rate changes in ever region (and many states have several overlapping jurisdictions that have different tax rates).

So how do MAS 90 and MAS 200 users manage the burden of sales tax compliance?

We’re going to talk about one solution today at 1pm.

It involves integration MAS 90 or MAS 200 with Speedtax which takes your shipping data and automatically computes the proper sales tax. The service also prepares the sales tax filings for you.

Quite honestly a lot of my customers only use these services AFTER an expensive tax audit convinces them of the need to pay attention to the details of collecting tax.

Stay ahead of the game (or at least be better informed of your options).

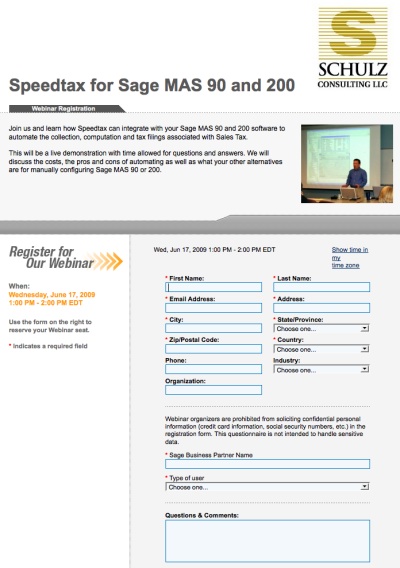

Register for this Wednesday (today) June 17 1pm EST seminar on

Sales Tax Compliance for MAS 90 and MAS 200 with Speedtax

Hi, Wayne

Wasn't able to make the webinar, unfortunately. Would like to know what your take is on Speedtax.

Thanks!

Hi, Wayne

Wasn't able to make the webinar, unfortunately. Would like to know what your take is on Speedtax.

Thanks!